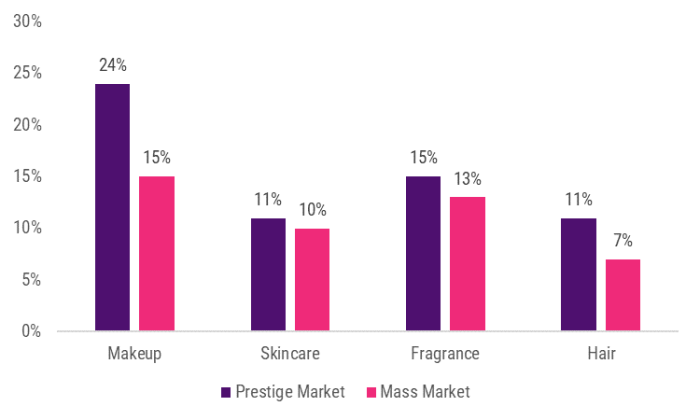

In the first quarter (Q1) of 2023, U.S. prestige beauty industry sales reached $6.6 billion, a 16% increase versus Q1 2022, according to point-of-sale data from Circana (formerly IRI and The NPD Group). In comparison, the mass beauty market generated $7.0 billion and grew 10%.

U.S. Complete Beauty Q1 Sales Performance by Category

Based on Sales Revenue, January-March 2023 versus 2022

Source: Circana/U.S. Prestige Beauty Total Measured Market and Beauty Mass Market Multi-Outlet Core Outlet

“Following a stellar 2022, the beauty industry continues to bask in the glow of growing sales,” said Larissa Jensen, beauty industry advisor at Circana. “The first quarter results reinforce beauty’s resiliency and unfaltering position as an indispensable category. As the prestige and mass industry lines blend, a clear picture of the complete beauty market becomes particularly important for brands and retailers to determine ‘where to grow from here’ and best harness the purchasing power of a consumer base that is already loyal to its products.”

As the fastest-growing category in Q1 across both the prestige and mass markets, makeup is making moves

- Makeup captured close to one-third of complete beauty sales revenue in Q1.

- Consistent with the “Lipstick Index” phenomenon and “treat” mindset Circana has been reporting, lip was the fastest-growing prestige makeup segment, up 43%, with higher-priced designer brand product growing even faster.

Skincare shows bright spots across both sides of the business

- Mass outpaced the prestige market for facial skincare sales, with sales up 13% in mass and 10% in prestige.

- In the prestige skincare market, clinical brands grew faster than natural brands, regaining leadership share, as new launches from clinical brands played a role in fueling sales.

Gift sets and mini sizes outperform in the prestige fragrance market

- Sales of fragrance gift sets sold in the prestige market grew by 31%, helped by more dedicated shelf space and consumers finding value in these types of products.

- Prestige fragrance sizes under 1 ounce accounted for nearly 40% of unit sales in Q1, a 3-point increase versus last year – appealing to consumers looking to easily carry their fragrances with them, or to own a luxury fragrance at a lower price-point.

Targeted treatments enrich sales for the prestige hair category

- While the mass market dominates when it comes to hair product sales, capturing three-quarters of total hair sales volume, sales in the prestige market continued growing at a faster clip in Q1.

- Hair experienced the highest year over year average price increase among all prestige beauty categories, driven by an increase in sales of products priced above $30.

- Sales of prestige hair products that address hair health, such as heat protectants, leave-in treatments, scalp care, and hair thinning products outperformed the overall category.

For more information or to speak with Larissa Jensen, please contact Marissa Guyduy at marissa.guyduy@circana.com.

Categorized in: Trends/Insights